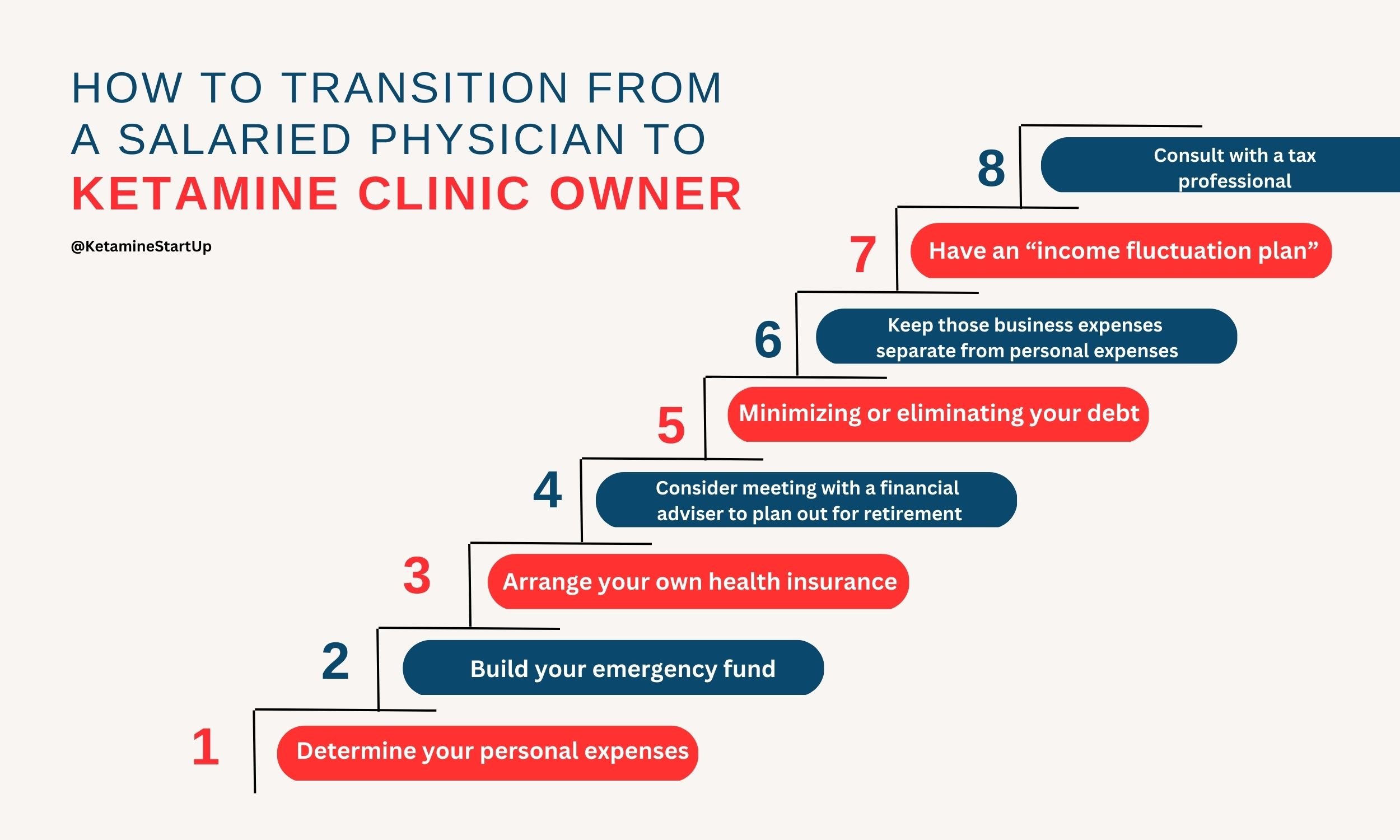

How To Transition From A Salaried Physician To Ketamine Clinic Owner - 8 Steps

In this blog, learn essential steps for transitioning from a salaried physician to a ketamine clinic owner, including personal financial planning, obtaining health insurance, and working with financial and tax professionals.

A question we often get is, “How did you go from salaried hospital employee to ketamine clinic owner?” Since we didn’t know what we were doing, we bootstrapped and stumbled along the way. We played things by ear, and pivoted and made mistakes.

Reflecting on all that we did, we wanted to share some key steps we took in regards to personal finances. In this blog we’re going to cover some essential steps as you transition from your salaried job and start your own ketamine clinic.

Note that this blog does not replace speaking with a personal financial planner, and we urge you to talk with one if you are serious. Our hope is this post will help give you enough information to take the first steps.

Step 1: Determine your personal expenses

The big question here is, “how much money do you need each month?” Consider all your monthly expenses like rent or mortgage, utilities, transportation, food, your kid’s tuition, entertainment, vacations, etc. Knowing how much money you need can help you make further calculations.

For example, you may want to have emergency funds, especially in those months that cash flow may be slow at the clinic. What’s also nice about this is that it can help you identify your “enough number”. How much money did you actually need? Sure, who doesn’t want to be a billionaire, but are you willing to do the things one needs to do to get that kind of money?

Knowing the amount of money to cover expenses can give you peace of mind, and also still enjoy life. You’ll know how much you need to save to start your business but also how much cash flow you need from your clinic. You’ve heard that old adage, “Once you're an Attending, live like a resident” and it's good advice.

When we started our clinic, we were both driving our old Hondas that got us through residency. We didn’t buy a Tesla or a mansion when we became Attendings. This helped keep our expenses low. Now no shame if you like the finer things in life, we do too. Know that you’ll have a higher personal monthly budget, and that can affect step #2.

Step 2: Build your emergency fund

How much of an emergency fund you want to build will depend on you. You can choose three months or six months, but some people even recommend nine months to a year! If you have higher monthly expenses, you may choose to have fewer months of emergency funds. Or you may take more time to save before starting your ketamine clinic.

Businesses take time to flourish. So while you wait for a steady flow of patients, these emergency funds will help cover all those expenses you calculated in step #1. You might be thinking, "I don’t need that much in emergency funds because ketamine clinics are a cash cow!" Nope, not for all, and especially not when you start out.

In our first month of operation, we had four infusions. Not four patients, four infusions. If we hadn’t saved (or kept our part-time positions) we would have been freaking out. Starting a ketamine clinic is not worth getting into financial hardships. So start doing some calculating and saving!

Step 3: Arrange your own health insurance

Plan out obtaining your own health insurance. Benefits like health insurance and retirement that employers provide will now be yours to arrange! You are now an employer too! Research your options of individual health insurance plans versus joining a spouse’s plan. The wonderful benefits at our salaried hospital jobs were great, but they weren’t enough to keep us anymore. At first Sam scaled back and joined Kim’s health plan. Then when Kim left, we obtained our own health insurance.

Step 4: Consider meeting with a financial adviser to plan out for retirement

Unless you already have a solid retirement plan, consider meeting with a financial adviser. You get to determine how much you’ll need to save to retire and make a plan to achieve your retirement goals. We had a solid retirement plan as we made our career pivot. We understood that we may have to take a pause or adjust how we would achieve our retirement goals.

Step 5: Minimizing or eliminating your debt

Consider paying off any outstanding debt or reduce it as much as possible. Doing this will free up more cash to pay your monthly expenses or investing in your ketamine clinic. Now for some of you, this isn’t going to be easy (hey there, fellow doctor with lots of medical school debt!), or your interest rate is so low you decide not to, which all make sense. Kim paid off her high interest medical school debt before she left her salaried position. On the other hand, Sam had a very low interest rate so it didn’t make sense for us to pay it off before going full time with the ketamine clinic.

Paying off educational debt versus saving for retirement is an interesting topic. Plus it's way outside the scope of this post. So you might want to check out The White Coat Investor, who we have learned a lot from.

Step 6: Keep those business expenses separate from personal expenses

This may or may not be obvious, but keep those personal expenses separate from your business expenses. This is to ensure accurate record-keeping and tax filing. You are now juggling both personal expenses (remember step #1?) and now the expenses of your business. This step is similar to arranging health insurance and other benefits for yourself.

We both enjoy spreadsheets and numbers, so we didn’t struggle too much with this starting out. If tracking these expenses sounds like a headache, definitely get help. Doing it right from the beginning will prevent headaches in the future.

Step 7: Have an “income fluctuation plan”

Some months you will be busy and other months you won’t. You can’t accurately predict how many patients you will see when you start out. Some of our students were lucky and had 20-30 infusions in the first month of opening. While others only had a handful.

In our first month, we had only four infusions. Cash flow was very low and we had to rely on our salary from our hospital jobs to cover our personal expenses. When we became busier, we were able to rely on clinic income to cover our expenses. Depending on your location and your medical community, you may have seasonal changes. For example, we're in Palm Springs where we are very busy in the winter but not in the hot summers. Have a plan to address those low cash flow months, like saving more during the more profitable months.

Step 8: Consult with a tax professional

Being a small business owner, you want to have some smart tax planning. So working with a tax pro is key to taking advantage of all available deductions. These deductions are one of the many perks of being a small business owner. You will get to access these tax perks that were unavailable to you when you had a salary. Remember step #6: keep your personal and business expenses separate. This is what you need to do, but also spares giving your accountant a headache.

Final Thoughts From Experienced Ketamine Clinics Owners

This blog is a bit on the lengthier side compared to our other blogs, but by no means is this a comprehensive list. Remember you still get to explore options to protect business and personal assets. Like insurance coverage and estate planning. The steps we did cover should get your wheels turning. After reading this, we hope that you are now more knowledgeable as you work with professionals to make this leap from employee to entrepreneur.

Was it scary when we took the leap? Yes! But when we finally started we were done with the traditional healthcare system. We were over the inefficiencies and inability to serve our patients in the way we believed in. So we were ready to take the risk and leap into the unknown.

Are you ready to begin exploring the possibility of opening and managing your own ketamine clinic? Join our email list and be notified about the next free webinar and open registration for Ketamine StartUp.

Related Questions:

What is the typical cost of starting a ketamine clinic, and what factors can influence this cost?

Start up costs can vary, especially in regards to location. A factor to consider is how much are you willing to do yourself. You can do more if you are a physician or licensed to administer medications. It’ll also depend on location size. Costs will be much lower if you sublet a room in a pre-existing medical clinic versus building out your own. We recommend having at least $75,000 to $150,000, plus running a lean business. Explore this answer more here.

How long does it usually take for a ketamine clinic to become profitable?

It depends. There are a lot of different factors that come into play. To create a profit prediction model means that you have to make a lot of assumptions about factors that affect your revenue and expenses, like population size, marketing, overhead etc. We were able to recoup our initial investment in our clinic within six months of opening. A question for you is, “How much money do you want to make?” and that goes back to making the calculations and planning we discussed above.

If you found this blog helpful, check out these too:

How Much Money Do You Need To Start A Ketamine Clinic?

How much do you really need to start a ketamine clinic? It all depends on the choices you make. Learn more about the factors that go into calculating your startup costs in this blog.

Are Ketamine Clinics Profitable? Part 1: Exploring Revenue

We get this question a lot, and we completely understand why. Leaving your stable hospital job to start a ketamine clinic is a risk and requires money. Will you be able to earn that money back and increase your income? In part one of this two-part blog series, we talk about the various factors that affect your clinic’s revenue.

Are Ketamine Clinics Profitable? Part 2: Exploring Expenses

Is opening a ketamine clinic going to financially reward you as much or more than your hospital job? Is it going to be worth the risk and investment? In the second part, we are going to answer this question plus the factors that affect how big your clinic’s expenses will be.

Texas proposes mandatory ketamine clinic registration, onsite physician requirements, and home-use ban. What it means for your practice and the industry.